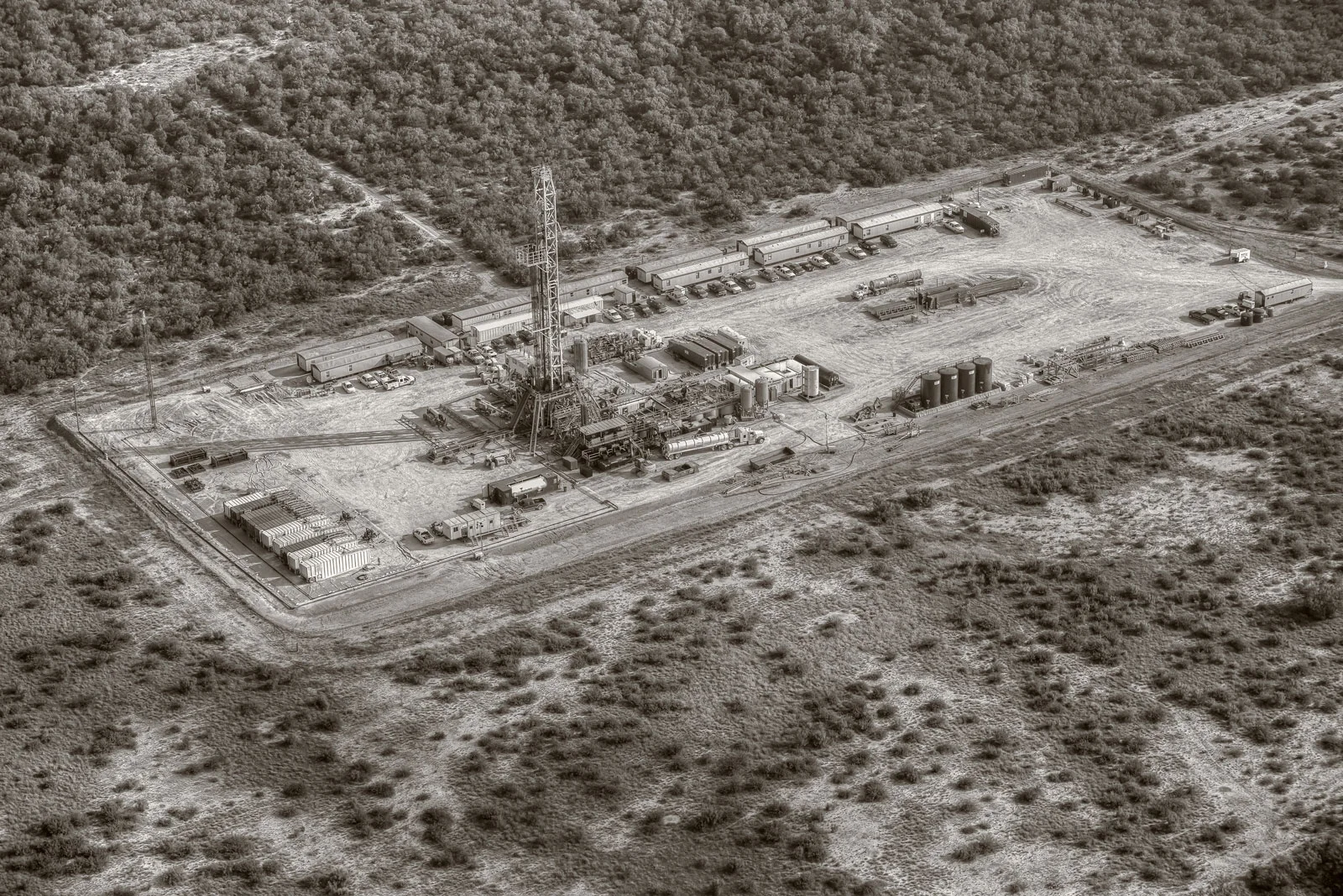

IMIC holds mineral rights in the Eagle Ford, Permian and Barnett combo in Texas. EOG, Murphy, Encana and Apache operate our assets.

US mineral rights can be acquired through but not limited to: auctions physical and online, from other oil companies, private landowners, the State or Federal Government.

A US mineral right is usually held in perpetuity.

Owning the mineral rights does not usually mean the owner also owns the surface rights, so the mineral rights owner will not usually have the right to i.e build a house on the land.

Mineral rights owners may lease the land to operators such as Exxon or Equinor, and by doing so give the mineral rights holder a royalty on any production from the land.

The operator who may have leased the mineral rights from the mineral rights owner, is usually responsible for the drilling units and necessary permissions to conduct drilling, development and production etc.

A mineral rights owner may be asked to participate in a drilling unit that covers his land and other people’s land, in this case the mineral rights owner can be “pooled in” to a drilling unit, resulting in the minerals owner getting a royalty respective to their share of the total pool, if the well is successful.

IMIC also holds an investment in Gemini Resources. Gemini is going after two unconventional plays in Poland. One is tight gas sand analogous to US unconventional gas plays. The Polish Permian basin is modelled analogous to the Mesa Verde Formation and the Cotton Valley Formation tight gas sands in the US. The other is for oil, which is analogous to the Bakken in North Dakota or San Andres in the Permian in Texas.